Signs You’re Spending Too Much

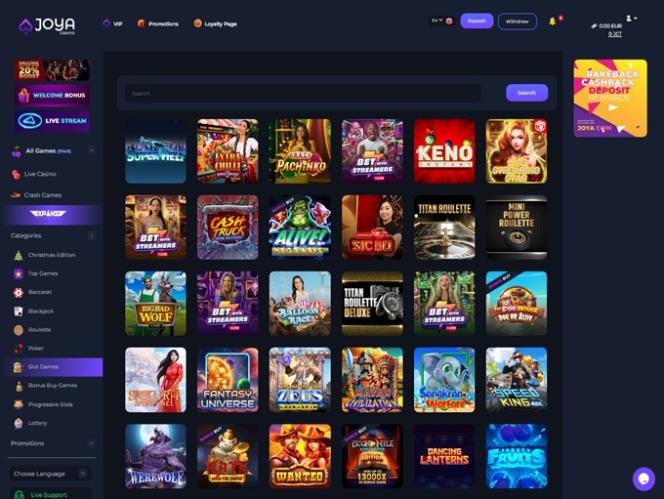

In today’s consumer-driven society, it’s easy to lose track of our spending habits. The thrill of a new purchase can overshadow our financial responsibilities. However, there are subtle signs that can signal when you’re spending too much. If you recognize these indicators and take them seriously, you can regain control of your financial health. One resource that may help you on this journey is Signs You’re Spending Too Much on Slots in Bangladesh ramstargames.com/bn, a platform dedicated to improving your spending habits through engaging tools and games.

1. You’re Living Paycheck to Paycheck

If you often find yourself counting down the days until payday, this could be a significant indicator that your spending is out of control. Living paycheck to paycheck means that you have little to no savings or disposable income left after your bills and essential expenses are covered. This cycle can be draining and can lead to anxiety and stress.

2. You Frequently Use Credit Cards

Credit cards can be a useful tool when used wisely, but if you’re relying heavily on them to make ends meet, it’s a red flag. If you find yourself making minimum payments, accumulating interest on your balances, or maxing out your cards, it might be time to assess your spending habits. Credit card debt can quickly spiral out of control, making it essential to be aware of your usage.

3. You’re Ignoring Your Budget

Having a budget is critical to managing your finances effectively. If you’ve created a budget but find yourself frequently ignoring it, that’s a strong sign you’re spending too much. A budget is meant to give you a clear picture of your financial situation and help you allocate your income effectively. Ignoring it can lead to overspending and financial distress.

4. You’re Making Regrettable Purchases

Impulse buys can be enticing, but if you often find yourself regretting your purchases shortly after, it’s an indication that your spending may be out of control. Reflecting on your spending and understanding what drives you to make these impulsive decisions is crucial. Create a pause between wanting and buying, allowing time to evaluate whether the purchase is necessary.

5. You Have Growing Financial Stress

Financial stress is a common issue for many people, but if it’s becoming a significant part of your daily life, it’s time to take a step back. High levels of stress over finances could indicate you’re spending beyond your means. Recognizing the link between your spending habits and your mental well-being is an essential step toward making positive changes.

6. You’re Unprepared for Emergencies

An emergency fund is crucial for financial stability. If you find yourself unprepared for unexpected expenses, like car repairs or medical bills, it could be a sign of excessive spending. Building an emergency fund should be a priority in your budgeting strategy to shield you from falling into further debt when crises occur.

7. You’re Missing Out on Savings Opportunities

Many people have goals such as saving for retirement, a home, or a dream vacation, but if you consistently spend your disposable income rather than saving, it might signify that your spending habits are skewed. Identify areas where you can cut back and redirect that money toward your savings. This shift can provide a sense of accomplishment and financial security.

8. You Feel Like You’re Always Shopping

If you notice that you have a constant urge to shop, even when you don’t need anything, this is a clear sign of potential overspending. Retail therapy may provide temporary relief, but the underlying issues often remain. Finding healthier ways to cope with emotions, such as engaging in hobbies or spending time with loved ones, might replace the need for shopping as an escape.

9. You Compare Yourself to Others

Social media can create unrealistic expectations regarding lifestyle and spending. If you find that you’re often comparing your life to those you see online, this might lead to compulsive spending as you try to keep up. It’s essential to remember that appearances can be deceiving, and many people only showcase their best moments rather than their financial struggles.

10. You Avoid Talking About Finances

Finally, if you find that discussions about money and finances make you uncomfortable or you avoid them altogether, it might indicate that your spending is a problem. Open communication about finances is key to addressing any issues. Consider discussing your situation with trusted friends or family members or seeking the guidance of a financial professional.

Conclusion

Recognizing the signs of excessive spending is the first step toward regaining control of your finances. By being honest with yourself and confronting any concerning habits, you can make informed decisions that lead to a more stable financial future. Remember, it’s never too late to implement changes and create a budget that aligns with your financial goals. Be kind to yourself during the process, and take it step by step.

Managing your spending effectively not only improves your financial situation but also enhances your overall well-being. By cultivating mindfulness in your financial habits, you can create a more rewarding and stress-free life.